With Baseline, it’s easy to service your loans in-house – saving you money and keeping you in control of your customers' experience.

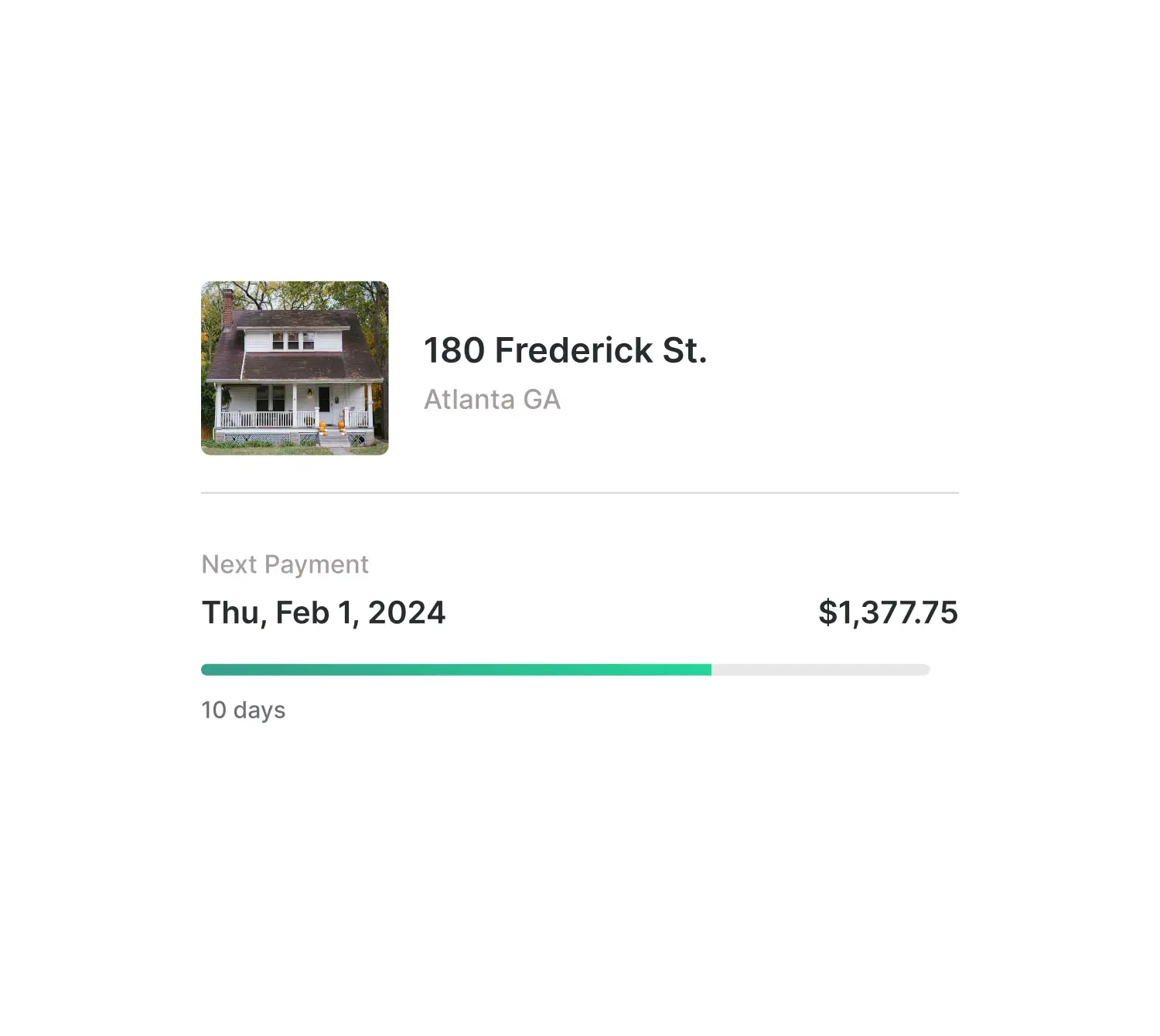

You’ve already done the hard work of bringing a borrower into your business. Keep that relationship close throughout the loan's lifecycle by delivering a smooth customer experience every time with online payments, digital statements and easy draw management.

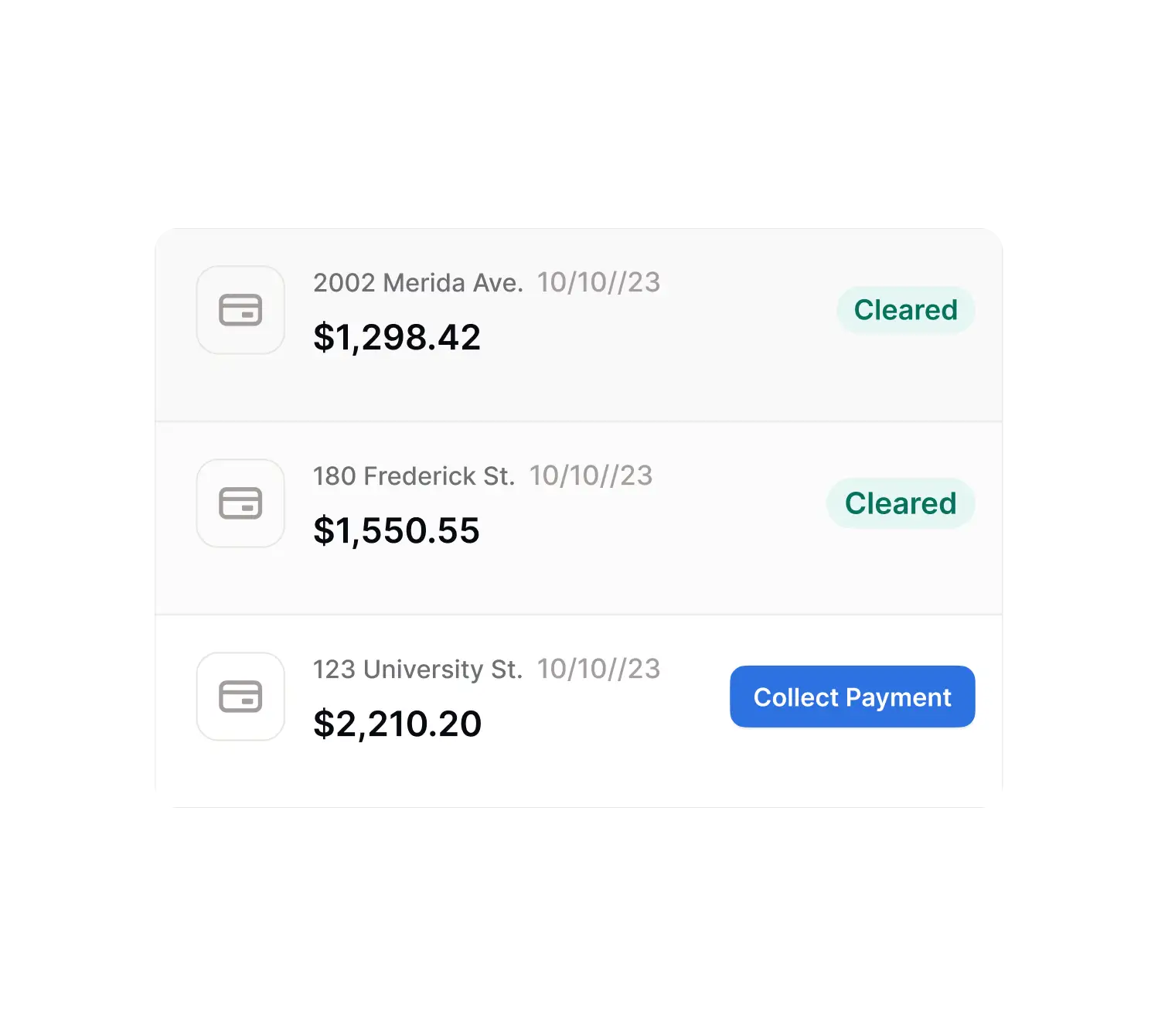

Easily manage and reconcile payments across loans while recording important events to maintain compliance.

Rehab or new build? No problem. Review and approve project budgets, track receipts and images, and release funds quickly – all within Baseline. You and your borrower are always on the same page.

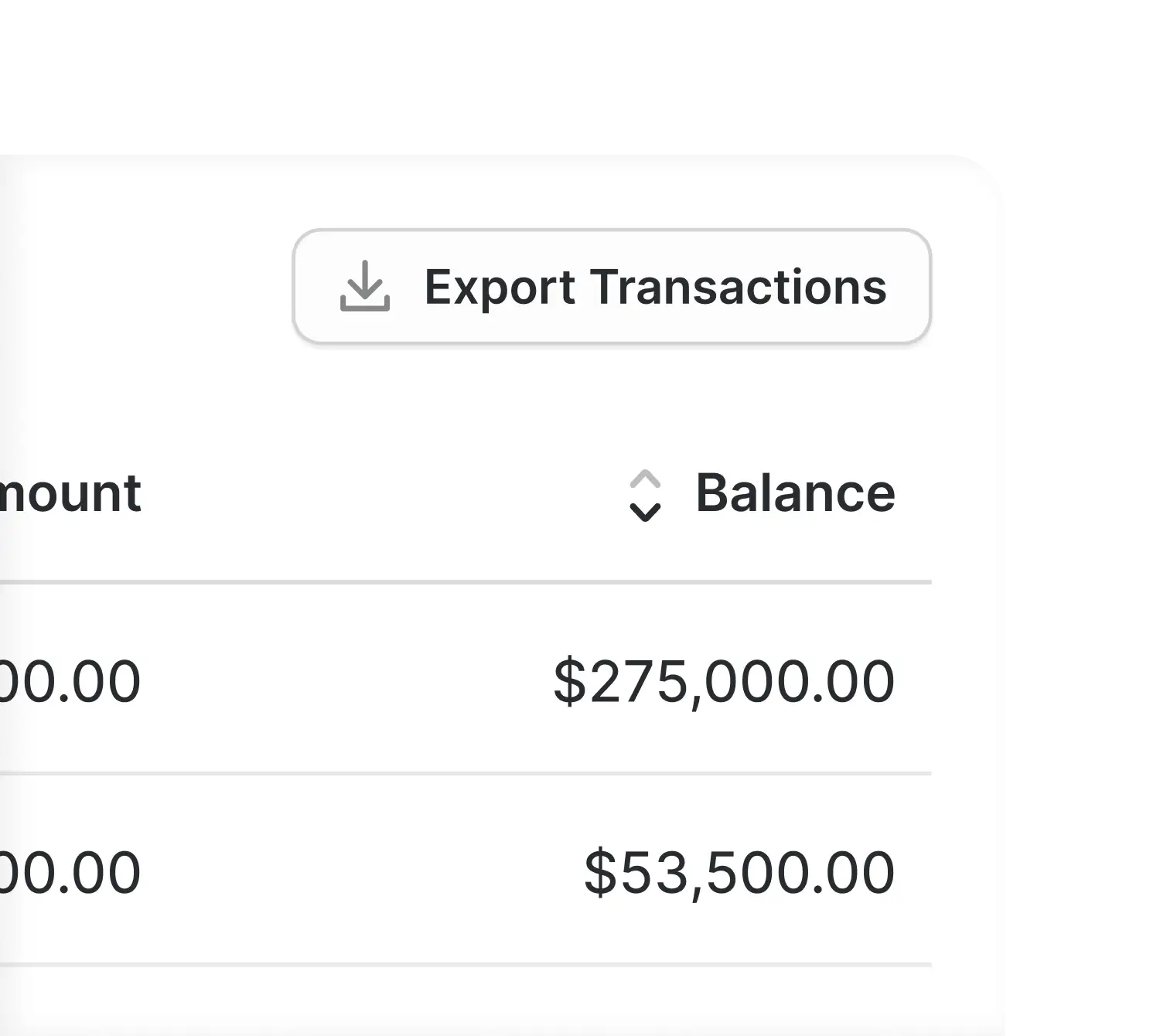

Get the information you need, quickly. User friendly reporting shows delinquencies, outstanding balances, and profits across your portfolio.

Pricing plans are based on active loan volume. All plans are month to month for ultimate flexibility.

Raise capital for your real estate private lending business efficiently and effectively with Baseline.

Discover what lending experts are thinking about and listen to their experiences.